شروط اخذ قرض ثاني من بنك التسليف 1443

selected Conditions for taking a second loan from the credit bank 1443 Several points differed according to the type of loan required, as the credit bank provides its banking services to customers in accordance with the provisions and controls that are compatible with Islamic law. The reference site will shed light on the conditions for obtaining a second loan from the credit bank, the conditions of the family loan, the credit bank, and the method of applying for the second loan in the credit bank.

Credit Bank

The principle of work of the Credit Bank since its establishment in 1971 was adopted to provide customers with social and professional loans, and soon afterwards, financing loans were added to buy cars in 201 AD. His name was transferred from the Credit Bank to the Social Development Bank in 2016, and the bank’s capital in 2013 amounted to 64 billion Saudi riyals. [1]

See also: Link to login to my credit bank account 1443

Conditions for taking a second loan from the Credit Bank 1443

A lending bank specified the conditions for taking a second loan as follows: [2]

- Conditions for taking a second family loan from the Credit Bank.

- Conditions for taking a second marriage loan from the credit bank.

- Conditions for taking a second restoration loan from the credit bank.

Each of the above types of loans will be explained in detail.

Conditions for taking a second family loan from the Credit Bank

The credit bank stipulated that customers wishing to obtain a second family loan from the credit bank must achieve the following points:

- Pay the first loan in full to the Social Development Bank.

- Achieving the general conditions and requirements for obtaining a family social loan from the Credit Bank, which has a maximum value of 60,000 riyals.

- The necessity of having a guarantor to obtain the second loan.

See also: Family loan terms Credit Bank 1443

Conditions for taking a second marriage loan from the credit bank

The Credit Bank or the Social Development Bank set the conditions for obtaining a second-time marriage loan with the following points:

- The death of the only wife.

- Divorce occurs before consummation of the wife.

- Marriage for the first time is excluded from the general conditions for obtaining a marriage loan only.

- Requires a guarantor to obtain the second loan for the marriage.

Conditions for taking a second restoration loan from the credit bank

The conditions for taking a second restoration loan from the credit bank were determined by each of the following points:

- 8 years have passed since applying for the first restoration loan in case of requesting a second financing on the same property from the credit bank.

- Pay all installments of the first restoration loan.

- Achieving the terms and conditions of obtaining a public restoration loan in the Credit Bank.

- The presence of a guarantor for the client to obtain the second loan.

See also: Conditions for a loan from the Credit Bank of 60 thousand riyals and how to obtain it

Conditions for taking a loan from the credit bank

The credit bank determined the general conditions that must be met to obtain a loan, according to the following: [2]

- Family loan terms bank credit.

- Marriage loan terms credit bank.

- Conditions of restoration loan Credit Bank.

Each of the previous items will be explained in detail below.

Family loan terms Credit Bank

The Credit Bank stipulated that customers wishing to obtain financing or a family loan from the bank must fulfill all of the following:

- The maximum age of the sponsor is 70 years and the maximum age of the sponsor is 55 years.

- The maximum monthly income of the customer is 12500 SAR.

- The maximum limit of the individual’s income in the client’s family is 3000 Saudi riyals, and it is calculated by dividing the client’s salary by the number of family members.

- The son is counted in the applicant’s family if he is over 24 years old, unemployed or single, for boys and girls.

- A woman is allowed to apply for a family loan if she is widowed or divorced and supports one or more children.

- The maximum limit for the regular financing is 60 thousand riyals and 30 thousand riyals for customers from the age groups between 60 to 65 years and 18,000 riyals for customers over 65 years and less than 70 years.

See also: Credit Bank, inquire about the rest of the installments, with ID number 1443

Marriage loan terms credit bank

The credit bank specified the condition for taking a public marriage loan for each of the following points:

- The maximum age of the applicant is 70 years and the maximum age of the sponsor is 55 years.

- The maximum monthly income of the customer is 12500 Saudi riyals.

- In the event of marriage for the first time, the client has the right to apply for a marriage loan only.

- That the wife holds the Saudi nationality or the nationality of one of the Gulf Cooperation Council countries.

- In the event that the wife’s nationality is non-Saudi or from outside the Gulf Cooperation Council countries, the husband who requested the loan must present a document of approval of the marriage from the competent authorities.

- Submit a court-certified marriage contract dated less than two Hijri years.

- The date of the duration of the marriage contract shall be in Hijri, and the time period shall be included from the date of submitting the application.

- The maximum financing limit for age groups between 60 and 65 years is 30,000 Saudi riyals and 18,000 Saudi riyals for customers aged between 65 and 70 years.

Conditions of the restoration loan Credit Bank

The Credit Bank stipulated that customers wishing to obtain a restoration loan should achieve each of the following points:

- The maximum age of the client is 70 years and the maximum age of the sponsor is 55 years.

- The minimum age of the customer applying for the restoration financing loan is 21 years.

- The maximum monthly income of the customer is 12500 SAR.

- The customer owns a title deed in the house to be renovated.

- The age of the house is 5 years and over.

- The minimum period for transfer of ownership of the property is one year and two years for the transfer of ownership of the property between first-degree relatives.

- The maximum area of the house to be renovated is 1000 square metres.

- Regular mortgage payments in case the house is mortgaged to the Ministry of Housing or the Real Estate Development Fund.

- If the house is mortgaged to the Ministry of Housing or to the Real Estate Development Fund, the owner must be regular in paying the installments, or he must bring from the fund what proves the understanding on the payment.

- The maximum limit for financing the restoration of popular homes is 30 thousand Saudi riyals.

- 18 thousand Saudi riyals, the value of the loan to finance the restoration of houses constructed from mud.

- The value of the loan for the restoration of the credit bank for houses built of concrete is 60 thousand Saudi riyals.

- The maximum financing value for customers in the age groups between 60 and 65 years is 30,000 Saudi riyals and 18,000 Saudi riyals for customers between 65 and 70 years old.

See also: Conditions of self-employment loan for women Credit Bank 1443

Terms of the sponsor in the credit bank

The conditions of the sponsor in the Credit Bank or the Social Development Bank were determined by each of the following points:

- The maximum age of a Saudi sponsor is 55 years.

- Undertaking and acknowledgment by the surety guarantor.

- Correctly fill out the personal guarantee form submitted by the bank.

- Enter the data of the valid national ID number and the national address of the sponsor.

- Write the sponsor’s mobile number in the sponsorship form.

- The sponsor’s approval to deduct the value of the loan entitlements by the employer working for the sponsor without restriction or condition.

- Approval of the sponsor sharing his financial data with SIMAH.

- Approval of deducting the credit bank’s dues in one go in the event that the customer changes his place of work without notifying him.

- Not to prolong the suspension of the guarantee, reduce the discount, or cancel the effectiveness of the guarantee when the sponsored customer is late in paying the value of the monthly dues.

- The approval of the employer working with the sponsor on the policy of deduction from the monthly dues.

- Acknowledgment by the employer to correspond with the credit bank and inform about the change of the guarantor’s place of work and the seizure of all his financial dues.

- The employer’s refusal of the sponsor to transfer the services of the sponsor to another party before notifying the bank of this, unless the sponsor submits a financial disclaimer notice from the loan.

See also: Form 104 Credit Bank

credit bank forms

Customers wishing to apply for a second loan from the credit bank can view the available forms, which include the following employer authorization form:

- Credit Bank Family Finance Model “From Here”.

- Credit Bank Bail Form 105 “From Here”.

- Credit Bank Form 104 Credit Bank “From Here”.

- The credit bank is a model for the abandoned clique “from here”.

- Credit Bank National Identity Matching Form “From Here”.

- The Credit Bank, the model for financing the restoration “from here”.

- Credit Bank Marriage financing form “from here”.

- The credit bank acknowledgment form of assignment and power of attorney in the case of heirs or partners in the case of the restoration loan “from here”.

How to apply for a second loan from the credit bank

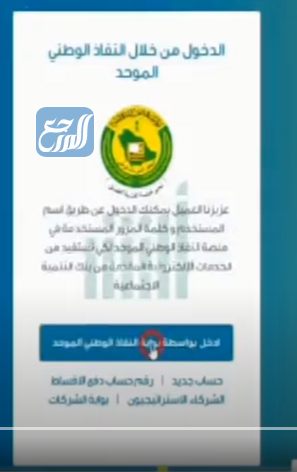

Customers who have fulfilled the conditions for obtaining a second loan from the Credit Bank may apply for it by following the following steps:

- Entering the official website of the Credit Bank “from here”.

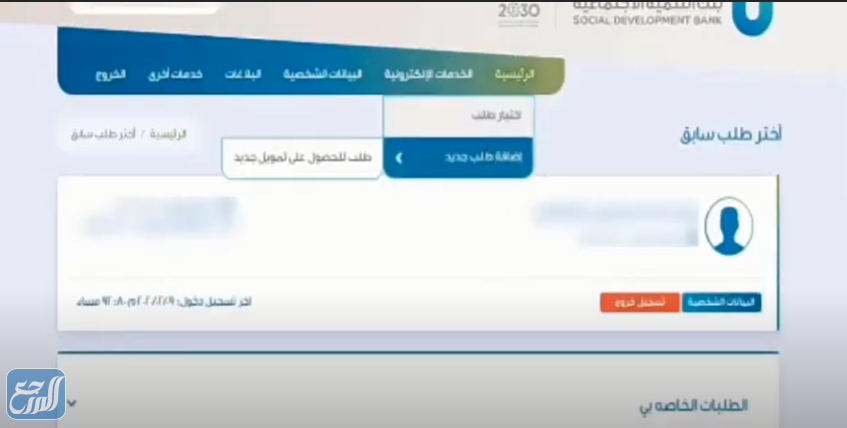

- Log in to the customer’s account through the Absher Single Access Portal, as shown in the figure below.

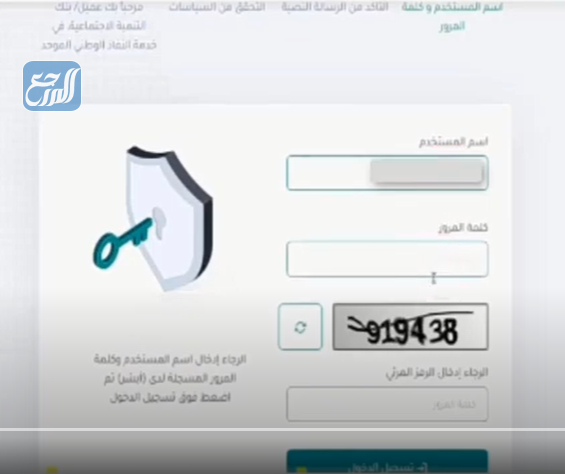

- Entering the customer’s data into the Absher platform with the username and password and logging in as shown in the picture.

- Authenticating the customer’s account in the bank by using the authentication code sent from Absher to the customer’s mobile.

- The customer transfers the loan applicant to the credit bank website and selects a new financing request from the main menu as shown in the figure.

- Click on Submit within the available financing products.

- Choose marriage financing, family financing or restoration financing from the list of individuals financing available in the bank.

- Agreeing to the terms and conditions and specifying the branch of the lending bank from which to collect the loan if the application is approved.

- Writing the loan or financing application data from the client.

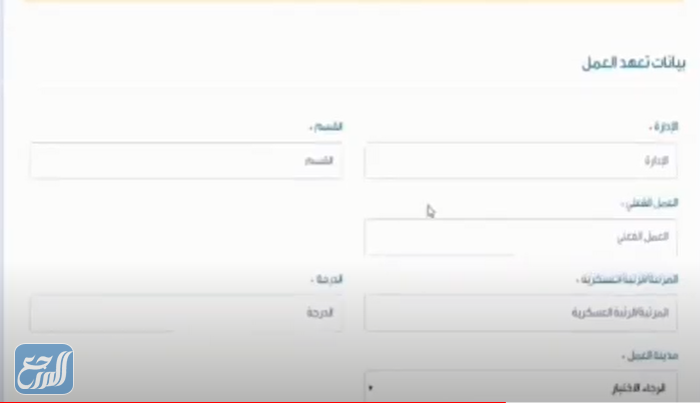

- Entering the data of the employer’s undertaking Form 140 correctly.

- Specify the required loan amount, press add, and then submit the request.

- The customer’s request for financing is processed and a mobile message is answered with the approval or rejection of the loan.

See also: Inquire about the credit bank, how much is left?

Conditions for obtaining a credit bank loan for divorced women

The credit bank set the conditions for divorced women to obtain a financial loan after achieving the following points:

- Proof of divorce by a legal deed or through the civil registry.

- Submit a document certified by civil status proving the marital status of the applicant for the loan.

- A copy of the identity card for the Saudi applicant.

- Advanced sponsor ID copy.

- Fill out Form 105 electronically and print it from the loan applicant’s account through the electronic channels of the Credit Bank with the official approved seals for a maximum approval period of two months.

- Name and signature of the applicant on the mail delivery form with the name and signature of the Saudi Post employee.

- A definition of the sponsor’s salary stamped by the employer for a period not exceeding 60 days.

- An identification of the applicant’s original IBAN account number, certified and stamped with the seal of the credit bank.

- My data permit for the client and the sponsor from the Saudi Ministry of Interior website is valid.

Finally, we have explained in detail Conditions for taking a second loan from the credit bank 1443 And the conditions for taking a loan from the credit bank and the conditions of the guarantor in the credit bank in addition to the conditions for obtaining a loan from the credit bank for divorced women and the method of applying for a second loan from the credit bank.